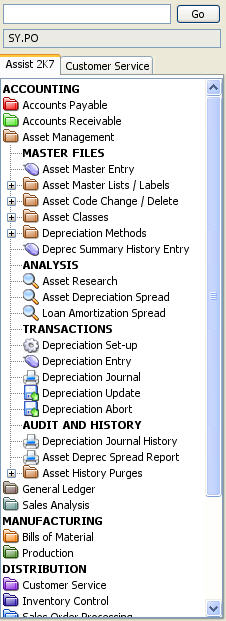

· Asset

Master Entry allows you to add, change and view information

on an asset. The program stores the current values of a minimum of three

(book, fe deral and state) reporting groups.

· Asset Master List / Labels

gives you the ability to print a list of assets by asset, class, description,

acquired period, disposed period, location, reference or asset account.

· Asset

Code Change / Delete gives you the ability to change or delete

an asset code without open or historical information being lost.

· Asset

Classes allow you to add, change, delete, view or print

information on reporting groups and asset classes.

· Depreciation

Methods allows you to add, change, delete or view methods

of depreciation. Methods that are supported are; ACRS, declining balance,

MACRS, sum of the year's digits, straight line and user defined.

· Deprec

Summary History Entry lets you to add, change and delete

summary depreciation history

· Asset

Research lets you view asset master information with options

to view Depreciation History or report group information.

· Asset

Depreciation Spread gives management a variety of tools

for viewing and graphing asset depreciation history.

· Loan

Amortization Spread allows you to calculate the principal

and interest amounts for a user defined loan amount. The principal and

interest amounts for each period with year to date and life to date

totals are displayed, and optionally printed.

· Depreciation

Set-up allows you to automatically generate the asset's depreciation

amount as defined in the Asset Master Entry program.

· Depreciation

Entry allows you to add, change, delete or view an asset's

depreciation for a posting period.

· Depreciation

Journal allows you to automatically post the asset depreciation

amounts to the General Ledger and Asset Management History files.

· Depreciation

Update allows you to automatically post the asset depreciation

amounts to the General Ledger and Asset Management History files.

· Depreciation

Abort allows you to abort the pending depreciation amounts

· Depreciation

Journal History gives you the ability to print a Depreciation

Journal for any posting period stored on the system.

· Asset

Depreciation Spread Report gives you the ability to print

the Depreciation Spread in report form.

· Asset

History Purges give you the ability to purge history through

a given cut-off period.